Analysing Your Competition

In business field, almost everyone in all companies struggle hard to perform better and compete their rivals through offering quality products and services. In order to survive and flourish in global market, it is necessary to gain competitive advantage. But many of the advantages that businesses rely on are not sustainable. They can be easily imitative, stolen or disproved. Real competitive advantages factors such as brand name recognition, patented manufacturing processes or exclusive rights to a scarce resource cannot be easily cliched. For getting success, companies are advised to conduct competitor analysis in marketing.

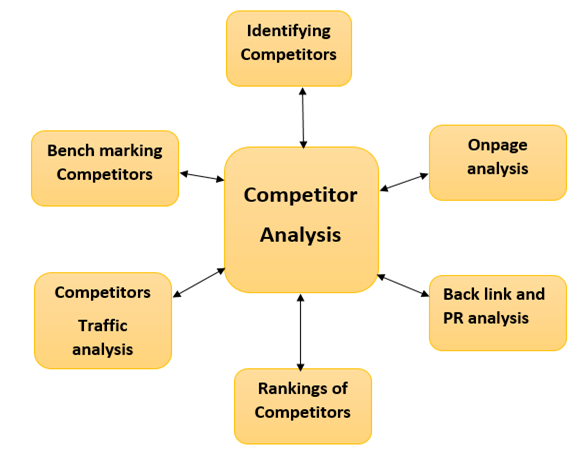

Competitor analysis is a valuation of the strengths and weaknesses of current and potential competitors. This analysis offers both an offensive and self-justifying strategic context to recognize opportunities and threats. Describing merges all of the relevant sources of competitor analysis into one framework in the support of effective strategy formulation, execution, monitoring and adjustment. Competitor analysis is an essential component of corporate strategy (Mark, 2014). Fundamentally, competitive analysis is elaborated as recognizing competitors and evaluating their strategies to determine their strengths and weaknesses relative to those of own product or service.

In simple term, Competitive strategy involves putting a business to exploit the value of the capabilities that discriminate it from its competitors. It follows that a central feature of strategy formulation is perceptive competitor analysis. The intent of a competitor analysis is to develop a profile of the nature and success of the likely strategy changes each competitor might make, each competitor's probable response to the range of possible strategic moves other firms could initiate, and each competitor's feasible reaction to the range of industry changes and broader environmental shifts that might occur.

Competitive analysis has long been a basis of overall competitive policy for multinational corporations. Moreover, business experts established that competitive analysis surpasses industry areas; indeed, the practice is deeply pertinent to all industries.

There are two major characteristic of competitor analysis. The first is to obtain information about the resources, behaviour and success of the firm's most important rivals and the second is to use the available information to attempt to predict and pre-empt the future strategies and behaviour of supposed competitors. As such, a company must have to determine the competitors for whom it will compete and which competitors, it has to avoid. The company will attain this by determining its competitors' current and expected future policies and actions, as well as how these competitors may respond to the actions of the firm itself. As part of this, the firm can also consider how it can influence the behaviour of its competitors and potential competitors to its competitive advantage. It can be done by discouraging future market entrants. Generally, this cannot be achieved by using casual or subjective knowledge instead it needs a planned and systematic investigation and analysis of competitors to gather comprehensive information and use it to make valuable strategic decisions.

The definitive objective of competitor analysis is to understand the behaviour of, and think like that competitor so the firm's competitive strategy can be formulated to take into account the competitors' expected actions and responses. Purpose of competitor analysis is to identify top competition, determine strengths/weaknesses of competition, develop strategies based on analysis to increase success and analyse successful and unsuccessful competitors.

Competitors of the firm are companies with a product/service addressing similar needs, products/services considered to be close substitutes.

One advantageous technique for competitor analysis is creating a competitor array. The steps include:

- Define industry - scope and nature of the industry.

- Determine who the competitors are.

- Determine customers and what benefits they expect.

- Determine what the main success factors are in industry.

- Rank the major success factors by giving each one a weighting. The sum of all the weightings must add up to one.

- Rate each competitor on each of the key success factors.

- Multiply each cell in the matrix by the factor weighting.

Media scanning is also important for analysing competitors. Scanning competitor's advertisements can expose much about what that competitor believes about marketing and their target market. Alterations in a competitor's advertising memo can disclose new product offerings, new production processes, a new branding strategy, a new positioning strategy, a new segmentation strategy, line extensions and contractions, problems with previous positions, insights from recent marketing or product research, a new strategic direction, a new source of sustainable competitive advantage, or value migrations within the industry. It also designate a new pricing strategy such as penetration, price discrimination, price skimming, product bundling, joint product pricing, discounts, or loss leaders. It specifies a new promotion strategy such as push, pull, balanced, short term sales generation, long term image creation, informational, comparative, affective, reminder, new creative objectives, new unique selling proposition, new creative concepts, appeals, tone, and themes, or a new advertising agency. Media scanning reveal new distribution strategy, new distribution partners, more extensive distribution, more intensive distribution, a change in geographical focus, or exclusive distribution.

Practically, a strategist needs to understand competitors' strategies. The strategist needs to be able to understand the situation as competitors see it and to analyse it so as to know what actions the competitors would take to maximize their outcomes to be able to calculate the actual financial and personal outcomes of the competitor's strategic choices. They must be able to:

- Estimate the nature and likely success of the potential strategy changes available to a competitor.

- Predict each competitor's probably responses to important strategic moves on the part of the other competitors.

- Understand competitors' potential reactions to changes in key industry and environmental parameters.

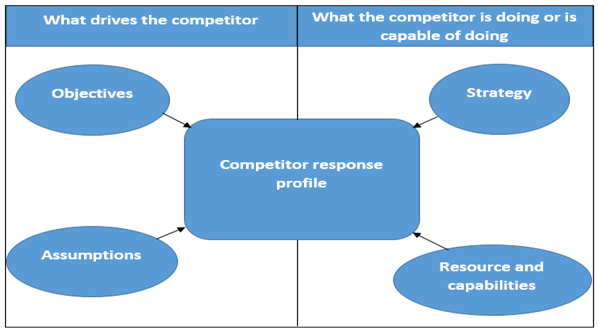

Michael Porter has offered framework of analysing competitors. This framework is based on following factors:

- Competitor's objective

- Competitor's assumption

- Competitor's strategies

- Competitor's capabilities

Components of competitor's analysis (Porter, 1980)

Competitor's Objectives: In order to analyse competitors, it is vital to comprehend the major objectives a competitor has. This will facilitate a company to foresee the actions of competitor in business and how their behaviour can be altered. It can be explained through example, when a company recognizes that one of its rivals is following profit margin and rate of return goals, then they may be reluctant to respond if the company undercuts their products, as reducing their price would decrease their profit margins and rates of return. As such, the company may be able to antagonistically grab market share from the competitor by taking a cost leadership strategy. Nevertheless, if a competitor pursue market share goals, then they are more likely to strongly defend against any outbreaks on their markets and cut prices to drive the new competitor out. Companies must determine their competitor's objectives by investigating their organisational structure.

Competitor's Strategy: Organizations also need to comprehend a competitor's strategy based on its existing business performance, as well as any announcements made by a competitor.

Competitor's Resources: In appraising competitors in marketplace, companies must understand how it may act in future and may respond to the company's actions, it is also important to determine resources of competitors and their capabilities to respond effectively to market fluctuations. Generally, the resources of a competitor will often be quite well known, as they will be the factors that the firm is using to generate its current revenues. It is significant for a company to look at the most important resources that its competitors use, as well as any areas of flaw that could be exploited. Consequently, an analysis of a competitor's resources is similar to a SWOT analysis, and also analysing the competitor's main market strengths which can help to describe its competences.

Though, the company also needs to consider the actions competitor could take to enhance its resources to protect against an attack. It has been established that the competitive environment tends to be vibrant therefore it is also important to scrutinise the ability of the competitor to respond immediately to any fluctuation in marketplace. It is observed that some corporations do not respond quickly to changes in marketplace due to lack of resources and hence the company will be able to target these competitors and gain significant market share before they respond. Other competitors may be able to respond fast to any attack on their market, making them unprofitable targets.

Competitor's Assumptions: The competitor's expectations about the market and their own business will influence the actions they will take to capture market. For example, if earlier products in a market have failed, competitors may undertake that any other types of product will fail. However, sometimes these assumptions create prospects.

Competitor Response Profile: When company gathers thorough details of a competitor's objectives, strategy, resources and assumptions, it can use this valuable information to create a response profile for the rival. This profile details all the potential moves which the competitor may make in response to the company's strategy, and how effective and significant these moves would be. The profile can include aggressive moves which the competitor may make into a new market, as well as defensive moves if a company attacks one of the competitor's existing markets. This profile can assist the company to forecast its competitors' behaviour, as well as attempting to influence this behaviour to the company's advantage.

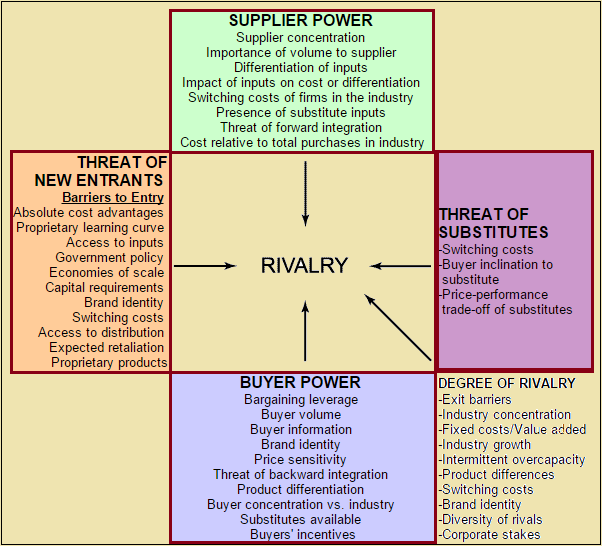

Bulk of management studies have documented that all companies have special strengths, and its company's capabilities to assess their potentials as well as rival's strength. It is always recommended by management experts to perform a formal SWOT (Strengths, Weaknesses, Opportunities and Threats) analysis. It is recognized that the five forces model was developed by Michael E. Porter to help companies evaluate the nature of an industry's competitiveness and develop corporate strategies consequently. The framework permits a business to recognise and analyse the important forces that determine the effectiveness of an industry. This analysis also assist companies to assess their strengths stack up against competitors' weaknesses and suggests ways to take advantage of marketplace opportunities. After performing the analysis, there are four basic competitive strategies to consider.

Porter's five forces

By under-pricing the competition, companies can achieve greater volume, which can drive their costs down even further by realizing economies of scale. Of course, it's important to still maintain a healthy profit margin so the key here is to lower costs, not just prices.

To analyse competitors, achieve product or service quality difference. To do this, companies must think about numerous companies that have achieved such differentiation for themselves.

In competitor analysis, companies must achieve supply or distribution leverage. Pursue a market niche, especially one that has been neglected by the dominant firm in industry. As companies grow, decisions often have to be made to discontinue servicing a particular segment. But that does not mean that the segment no longer has needs. It just means that the larger company can no longer provide for them efficiently.

It is imperative to evaluate competitors by placing them in strategic groups according to how directly they compete for a share of the customer's money. For each competitor or strategic group, list their product or service, its profitability, growth pattern, marketing objectives and assumptions, current and past strategies, organizational and cost structure, strengths and weaknesses, and size (in sales) of the competitor's business.

Companies must analyse current competitors to flourish in global market. Additionally, it is also recommended to estimate future competitive intimidations. Common sources of new competitors are:

- Companies competing in a related product/market

- Companies using associated technologies

- Companies already targeting your prime market segment but with unrelated products

- Companies from other terrestrial areas and with similar products

- New start-up companies organized by former employees and/or managers of existing companies

The entrance of new competitors is expected when:

- There are high profit margins in the industry.

- There is insufficient supply in the industry.

- There are no major obstacles to entry.

- There is future growth potential.

- Competitive rivalry is not powerful.

- Gaining a competitive advantage over existing firms is possible.

It can be established that a competitive analysis is a critical part of company marketing plan. With this evaluation, company can establish uniqueness of its product or service and put special features in order to attract target market. Currently, market is highly competitive and in order to gain and maintain a competitive advantage, strategy needs insight to deliver against company objectives. Competitive analysis can offer ambitious entrepreneurs with a good understanding of the marketplace conditions in an industry they are considering breaking into, or help established businesses to refine their strategic directions. Competitive analysis enable strategic planners to develop matrixes for recognising unserved or underserved gaps in the market. Competitive analysis can expose trends in the marketplace and offer benefits of being able to spot opportunities for differentiating your products and services.

Though competitor analysis is advantageous to films, it is criticised by many experts. Some economists raised concern that there is flaw in competitive analysis practices. They note that competitive analyses that are imperfect or based on incorrect data can lead businesses to construct faulty business strategies. Analysts have also indicated that traditional competitive analysis has become more complex and potentially time-consuming, since so many businesses offer diversified products and services. Others group of researchers oppose that excessive preoccupation with keeping pace with the strategies, products, and services of other competitors can result in atrophy in internal originality of production and design.

To summarize, competitive Analysis is a procedure to collect and assess information about company's competitors, their practices, products, strengths and weaknesses and business trends in order to weigh its position in the market and improve products and marketing strategies. Competitive Analysis gives an accurate view of competition. It also gives the opportunity to identify improvement in areas like manufacturing processes, customer services, and marketing claims. It can help to compare products prior to making company's marketing and promotional decisions. In this way, company can save both time and money.