Generally Accepted Accounting Principles

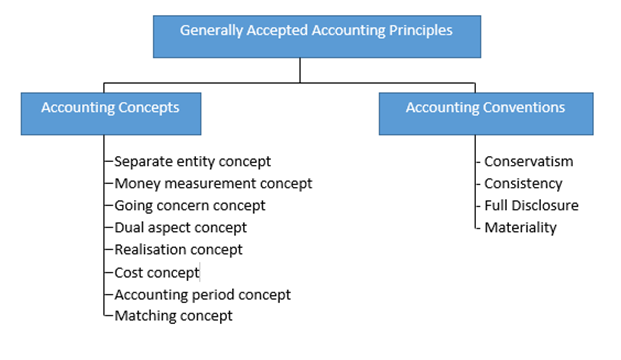

Generally Accepted Accounting Principles (GAAP) is described by management theorists as the standard framework of guiding principle for financial accounting used in any given authority. These are normally known as accounting standards. The notion of Generally Accepted Accounting Principle includes the standards, conventions, and rules that accountants pursue in recording and summarizing accounting transactions, and in the preparation of financial statements. Generally Accepted Accounting Principles (GAAP) is based on those rules of action or conduct, which are derived from experience and practice, and when they confirm useful, they are accepted as principles of accounting. GAAP is a codification of how CPA firms and company plan and present their business income and expenditure, assets and liabilities in their financial statements. GAAP is not considered as a sole accounting law, but it is a collective of many rules on how to account for different transactions.

GAAP in U.S.: The United States government does not openly establish accounting standards by law. However, the U.S. Securities and Exchange Commission (SEC) necessitates that US GAAP be followed in financial reporting by publicly traded companies. Presently, the Financial Accounting Standards Board (FASB) set up generally accepted accounting principles for public and private companies, as well as for non-profit organizations.

Historical framework of Generally Accepted Accounting Principles: traditionally, accounting standards have been established by the American Institute of Certified Public Accountants (AICPA) subject to Securities and Exchange Commission regulations. The AICPA first formed the Committee on Accounting Procedure in 1939, and substituted it with the Accounting Principles Board in 1951. In 1973, the Accounting Principles Board was replaced by the FASB under the supervision of the Financial Accounting Foundation with the Financial Accounting Standards Advisory Council serving to recommend and provide input on the accounting standards. Circa 2008, the FASB issued the FASB Accounting Standards Codification, which updated the thousands of US GAAP statements into approximately 90 accounting topics. In 2008, the SEC issued an introductory plan that may lead the U.S. to discard GAAP in the future and to join more than 100 countries at global level already using the London-based IFRS. As of 2010, the convergence project was in progress with the FASB meeting regularly with the IASB. The SEC articulated its resolve to fully accept IFRS in the U.S. by 2014. GAAP is used as a rule to offer comprehensive information for organization's fiscal returns, current balance and any outstanding debt.

It has been revealed in accounting literature that most companies must publish annual audited financial statement. Registered public companies and several private investment companies are required to publish audited statements. These financial statements must conform to the rules established by FASB (McCrary, 2009).

There are various factors in GAAP:- Accounting concepts:

The separate entity concept: From an accounting perspective, the business company is treated as a separate economic entity. It has been established that only business entity's actions and transactions must be recorded and reported. The personal activities of possessors and other business entities are accounted for separately unless the activities have direct impact on business firm.

Money Measurement Concept: Accounting records of only those transactions that can be expressed, in terms of money, though quantitative records are kept, additionally. If the events or transactions cannot be expressed in monetary value, however important they are, they are not recorded in accounts. The money measurement concept augments the true understanding of the state of affairs of the business.

Dual Aspect Concept: This is the fundamental concept of accounting. As per this concept, for every debit, there is a corresponding credit. It can be said that when a transaction is recorded, debit amount has to be equal to the credit amount. This is also termed as 'Double Entry Principle'. No transaction is complete without double aspect.

The continuing concern concept: This acknowledges that company will stay in organization in operation for predictable future. The firm is anticipated to function long time to accomplish its obligation and plans. This concept entails that accountant does not take into account the market value of the fixed asset (forced value of asset, as if business would be liquidated) for preparing balance sheet. Depreciation is charged on the original cost of the fixed assets on the basis of the expected lives, considering that the business would continue, in future, at least for a reasonable period, at least sufficient to the life of the assets. At the time of preparing the final accounts, company must consider the outstanding expenses and prepaid expenses on the presumption that the business will continue in future too. It is to be established that the 'Going Concern Concept' does not involve permanent continuation of the enterprise, indefinitely.

The time period concept: It identifies that timely financial reports must be made to those who need the information in such reports. It can be monthly, quarterly or annually. The year is the basic time limit. This time interval is called accounting period. At the end of each accounting year, Profit and Loss Account and Balance Sheet are prepared. Profit and Loss Accounts demonstrates the financial results, while Balance Sheet shows the financial position. When making comparison, the accounting period should be similar.

The consistency principle asserts that once an accounting procedure must be accepted, it must be consistently followed from period to period in order to compare accounting information.

The principle of conservatism: This principle states that when correct accounting options are available to record or report transactions, the accountant must select the alternative that will result in least favourable outcome for the business in current period. It minimizes any overstatement of assets, income and understatement of liabilities.

The objectivity principle: This asserts that all business transactions must be supported by objective evidence that proves transaction did occur. When independent evidence is not available to document the result of the business transactions, estimates must be made.

Materiality principle declares that material principle must be accounted in accordance with accounting rules.

Monetary unit concept describes that business transactions must be recorded and reported in terms of money.

The cost principle: This principle affirms that most assets and liabilities are recorded at their transaction cost. Cost is the basis for all accounting in respect of fixed assets. It provides an objective and verifiable basis for initial recording of assets and liabilities.

The revenue recognition; It holds that revenue generated form the business transaction should be recorded only when the sale has been made. Cost concept give benefit of objectivity in the preparation and presentation of financial statements.

The matching principle: This principle states that business entity's operational efforts be matched to the operational accomplishments. It holds that all statements must be recorded in the accounting period as the profits which they helped to generate. Matching concept requires proper adjustment for deferred expenditure. Deferred expenditure is that amount of expenditure that has been incurred but not charged to profit and loss account and postponed for charging against a future period. The argument is the benefit of the expenditure would last over the future period. Deferred expenditure is amortized on the basis of this matching concept. Relying on this concept, the deferred expenditure would be charged against the future incomes of the business.

- Accounting conventions:

Accounting Conventions states usages and customs of accounting which guide to prepare accounting statements.

There are different types of Accounting Conventions:

- Conservatism: This convention holds that accountant must operate safely. According to this, whenever there are two equally acceptable methods, the one, which is more conservative, will be accepted.

- Consistency: Consistency is a primary assumption of accounting. It is supposed that, Accounting Practices are unchanged, year after year. If the accounting practices are changed, the fact is to be mentioned and its impact is to be quantified.

- Materiality: 'Materiality' denotes to the comparative significance of an item or event. This convention highlights that all material facts is recorded in accounting. Accountant should attach importance to material details and ignore irrelevant details. While sending a statement of account to the debtor, the exact amount receivable from the concerned debtor is to be revealed.

- . Full disclosure principle: According to this principle, the financial statement of the business should be complete and should report adequate economic information linked with business entity to fully understand the statement. Information may be financial statement or supplementary attachments. The Convention of 'Disclosure' means that all material facts must be disclosed in the financial statements.

To summarize, Generally Accepted Accounting Principles is basically rule, procedure and conventions that is required to explain accepted accounting practice at particulate time. Accounting theoretical studies have shown that basic objective behind the accounting principles is that the accounting statements should be both reliable and informative. This objective can be accomplished when there is certain common agreement and compliance about the accounting principles.