Capital budgeting

Major role of the financial management is the selection of the most gainful assortment of capital investment and it is vital area of decision-making for the financial manger because any action taken by the manger in this area affects the working and the success of the firm. Capital budgeting is the planning process used to regulate whether an organization's long term investments such as new machinery, replacement machinery, new plants, new products, and research development projects are worth the funding of cash through the firm's capitalization structure (debt, equity or retained earnings). It is the procedure of allotting resources for major capital, or investment, expenditures (Sullivan, 2005). It is also stated by financial scholars that capital budgeting is the decision making process by which a firm appraises the purchase of major fixed assets including building, machinery and equipment.

Bulk of management literature explained the notion of the capital budgeting. Hamption, John specified that Capital budgeting is concerned with the firm's formal process for the acquisition and investment of capital. Several management experts have defined capital budgeting. Charles T. Homgreen elaborated that , "Capital Budgeting is long-term planning for making and financing proposed capital outlays." According to Richards and Greenlaw, "The capital budgeting generally refers to acquiring inputs and long-run returns." G. C. Philipattos stated that "Capital budgeting is concerned with the allocation of the firm's scarce financial resources among the available market opportunities. The consideration of investment opportunities involves the comparison of the expected future streams of earnings from a project; with the immediate and subsequent stream of expenditures for it."

According to Joel Dean, "Capital Budgeting is a kind of thinking that is necessary to design and carry through the systematic programme for investing stockholders' money. The idea of capital budgeting has an immense importance in project selection as it supports in planning capital required for completing long-term projects. Selection of a project is a major investment decision for an organization

The capital budgeting process can be successful if company determines the total capital expenditure for a project that is expected to generate returns over a particular period of time. An organization uses various methods to determine the total expenditure for a project and rate of return yielded from it. Some of the popular techniques are net present value, internal rate of return, payback period, sensitivity analysis, and decision tree analysis.

Goals of capital budgeting:

Prime goals of capital budgeting investments is to upturn the value of the firm to the shareholders. It has also an objective to rank projects and raise funds. Basically, the purpose of budgeting is to provide a forecast of revenues and expenditures and construct a model of how business might perform financially. It means to construct a model of how a business might perform financially if certain strategies, events, and plans are carried out. It empowers the actual financial operation of the business to be measured against the forecast, and it establishes the cost constraint for a project, program, or operation. Budgeting helps to aid the planning of actual operations by forcing managers to consider how the conditions might change, and what steps should be taken in such an event. It encourages managers to consider problems before they arise. It also helps co-ordinate the activities of the organization by compelling managers to examine relationships between their own operation and those of other departments.

Important objectives of capital budgeting:

- To ensure the selection of the possible profitable capital projects.

- To guarantee the effective control of capital expenditure in order to achieve by forecasting the long-term financial requirements.

- To make estimation of capital expenditure during the budget period and to see that the benefits and costs may be measured in terms of cash flow.

- Determining the required quantum takes place as per authorization and sanctions.

- To expedite co-ordination of inter-departmental project funds among the competing capital projects.

- To guarantee maximization of profit by allocating the available investible.

Other vital functions of a budget include:

- To control resources.

- To communicate plans to various responsibility centre managers.

- To motivate managers to strive to achieve budget goals.

- To evaluate the performance of managers.

- To provide visibility into the company's performance.

Principles of Capital Budgeting Decisions:

A decision regarding investment or a capital budgeting decision involves the following principles:

- A careful approximation of the amount to be invested.

- Original search for profitable opportunities.

- A careful estimates of revenues to be earned and costs to be incurred in future in respect of the project under consideration.

- A listing and consideration of non-monetary factors influencing the decisions.

- Evaluation of various proposals in order of priority having regard to the amount available for investment.

- Proposals should be controlled in order to avoid costly delays and cost over-runs.

- Evaluation of actual results achieved against those budget.

- Care should be taken to think all the implication of long range capital investment and working capital requirements.

- It should identify the fact that greater benefits are preferable to smaller ones and early benefits are preferable to latter benefits.

The necessity of capital budgeting can be highlighted taking into consideration the nature of the capital expenditure such as heavy investment in capital projects, long-term implications for the firm, irretrievable decisions and complicates of the decision making. Its importance can be judged on the following other grounds:

- Indirect Forecast of Sales: The investment in fixed assets is associated with future sales of the firm during the life time of the assets purchased. It demonstrates the possibility of expanding the production facilities to cover extra sales shown in the sales budget. Any failure to make the sales prediction would result in over investment or under investment in fixed assets and any inaccurate forecast of asset needs may lead the firm to serious financial results.

- Comparative Study of Alternative Projects: Capital budgeting makes a comparative study of the alternative projects for the replacement of assets which are wearing out or are in danger of becoming outdated so as to make the best possible investment in the replacement of assets. For this purpose, the success of each projects is appraised.

- Timing of Assets-Acquisition: It is emphasized by financial experts that appropriate capital budgeting leads to proper timing of assets-acquisition and improvement in quality of assets purchased. It is due to nature of demand and supply of capital goods. The demand of capital goods does not arise until sales impinge on productive capacity and such situation occur only intermittently. Alternatively, supply of capital goods with their availability is one of the functions of capital budgeting.

- Cash Forecast: Capital investment requires substantial funds which can only be organised by making determined efforts to guarantee their availability at the right time. Thus it helps cash forecast.

- Worth-Maximization of Shareholders: The impact of long-term capital investment decisions is far reaching. It safeguards the interests of the shareholders and of the enterprise because it avoids over-investment and under-investment in fixed assets. Through selection of lucrative projects, the management accelerates the wealth maximization of equity share-holders.

- Other Factors: The following other factors can also be considered for its importance:

- It helps in formulating a sound depreciation and assets replacement strategy.

- It may be beneficial in considering methods of coast reduction. A reduction campaign may necessitate the consideration of purchasing most up-to-date and modern equipment.

- The practicability of replacing manual work by machinery may be seen from the capital forecast be comparing the manual cost and the capital cost.

- The capital cost to enhance working conditions or safety can be obtained through capital expenditure estimating.

- It enables the management to develop the long-term plans and assists in the formulation of general strategy.

- It assesses the impact of capital investment on the revenue expenditure of the firm such as depreciation, insure and there fixed assets.

Basically, the firm may be challenged with three types of capital budgeting decisions:

- Accept-Reject Decision: This is a major decision in capital budgeting. If the project is accepted, the firm would invest in it. If the proposal is rejected, the firm does not invest in it. In general, all those proposals which produce a rate of return greater than a certain required rate of return or cost of capital are accepted and the rest are rejected. Through this criterion, all independent projects are accepted. Independent projects are the projects that do not compete with one another in such a way that the acceptance of one precludes the possibility of acceptance of another. Under the accept-reject decision, all independent projects that satiate the minimum investment standard, should be executed.

- Mutually Exclusive Project Decision: Mutually Exclusive Project Decision usually compete with other projects in such a way that the approval of one will reject the acceptance of the other projects. The alternatives are mutually exclusive and only one may be chosen. For example, firm is intending to buy a new folding machine. There are three competing brands, each with a different initial investment and operating costs. The three machines denote mutually exclusive alternatives, as only one of these can be selected. Furthermore, the mutually exclusive project decisions are not independent of the accept-reject decisions. The project should also be acceptable under the latter decision. Thus, mutually exclusive projects get significance when more than one tender is acceptable under the accept-reject decision.

- Capital Rationing Decision: Capital Rationing Decision is applicable when in a situation where the firm has unlimited funds, all independent investment proposals yielding returns greater than some pre-determined level are accepted. Nevertheless, this situation does not succeed in most of the business forms in actual practice. They have a fixed capital budget. A large number of investment proposals compete for these limited funds. The firm must, therefore, share them. The firm assigns funds to projects in a manner that it maximises long-run returns. Therefore, capital rationing denotes to a situation in which a firm has more acceptable investments than it can finance. It is related with the selection of a group of Investment proposals out of many investment proposals acceptable under the accept-reject decision. Capital rationing utilizes ranking of acceptable Investment projects. These projects can be ranked on the basis of a pre-determined principle such as the rate of return. The projects are ranked in downward order of the rate of return.

Components of Capital Budgeting:

1. Initial Investment Outlay: It comprises of the cash necessary to obtain the new equipment or build the new plant less any net cash proceeds from the disposal of the replaced equipment. The initial outlay also includes any additional working capital related to the new equipment. Only changes that occur at the launch of the project are included as part of the initial investment outlay. Any additional working capital required or no longer needed in future period is accounted for as a cash outflow or cash inflow during that period.

Net Cash benefits or savings from the operations: This component is calculated as under.

(The incremental change in operating revenues minus the incremental change in the operating cost = Incremental net revenue) minus (taxes) plus or minus (changes in the working capital and other adjustments).

Terminal Cash flow: It consist of the net cash generated from the sale of the assets, tax effects from the termination of the asset and the release of net working capital.

The Net Present Value technique: The Net Present Value technique is common among all techniques used. Under this method, a project with a positive NPV suggests that it is worth investing in.

Phases of capital budgeting:

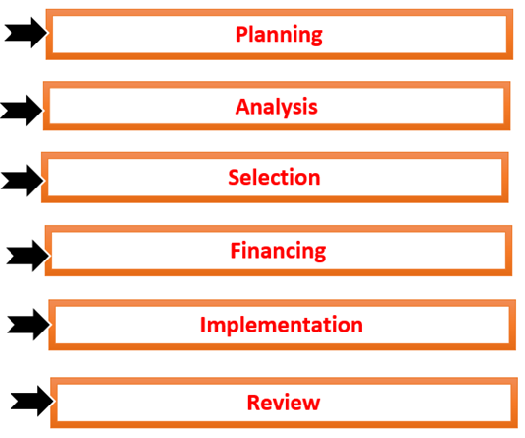

There are many phases of capital budgeting.

Phases of capital budgeting:

- Planning: The planning phase encompasses investment strategy and the generation and preliminary screening of project proposals. The investment strategy offers the framework that shapes, guides and demarcates the identification of individual project opportunities.

- Analysis: If the preliminary screening proposes that the project is worth investing, a detailed analysis of the marketing, technical, financial, economic, and ecological aspects is conducted.

- Selection: The selection process addresses the matter whether the project worth investing. Several appraisal criteria has been advised to judge the value of a project. There are two general categories.

- Non-Discounting criteria.

- Discounting criteria.

Some selection rules for both methods are as follows:

|

Non-discounting Criteria |

Accept |

Reject |

|

Payback Period (PBP) |

PBP < Target period |

PBP > Target period |

|

Accounting Rate of Return (ARR) |

ARR > Target Rate |

ARR < Target Rate |

|

Non-discounting Criteria |

Accept |

Reject |

|

Net Present Value (NPV) |

NPV > 0 |

NPV < 0 |

|

Internal Rate of Return (IRR) |

IRR > Cost of

capital |

IRR < Cost of

capital |

|

Benefit- Cost Ratio (BCR) |

BCR > 1 |

BCR < 1 |

4. Financing: After choosing a project, proper financing must be made. Equity and debt are two major sources of Finance for a project. Flexibility, risk, income, control and taxes are the vital business considerations that influence the capital structure decision and the choice of specific instruments of Financing.

5. Implementation: The implementation phase for an industrial project, which involves the establishing manufacturing facilities has several stages:

I. Project and engineering designs

II. Negotiations and contracting

III. Construction

IV. Training

V. Plant commissioning

6. Review: Once the project is commissioned, a review phase has to be done. Performance review should be done occasionally to compare the actual performance with the projected performance. In this stage, feedback is beneficial in several ways:

I. It focuses on realistic assumptions.

II. It provides experience, which will be valuable in future decision making.

III. It recommends corrective action.

IV. It supports to uncover judgmental biases.

V. It promotes the need for caution among project sponsors.

Techniques of Evaluating Capital Investment Proposals:

There are numerous appraisal methods which may be suggested to assess the capital investment proposals. Most widely accepted methods are grouped into the following categories:

I. Traditional Methods:

Traditional methods are further divided into the following:

(1) Pay-back period method or Pay-out method.

(2) Improvement of Traditional Approach to Pay-back Period Method.

(a) Post Pay-back profitability Method.

(b) Discounted Pay-back Period Method.

(c) Reciprocal Pay-back Period Method.

(3) Rate of Return Method or Accounting Rate of Return Method.

II. Time Adjusted Method or Discounted Cash Flow Method

Time Adjusted Method further classified into:

i. Net Present Value Method.

ii. Internal Rate of Return Method.

iii. Profitability Index Method.

Levels of Decision Making:

Capital budgeting decisions are categorized into these three decision levels.

- Operating capital budgeting: This may comprises of routine minor expenditures, such as expenditure on office equipment. The lower or the middle level management can manage the operating capital budgeting decisions.

- Administrative capital budgeting: This involves medium-size investments such as expenditure on expansion of existing line of business. Administrative capital budgeting decisions are semi-structured in nature, and they may also involve some alternatives, such as option to delay. Usually, the senior management is allocated the responsibility of handling these decisions.

- Strategic capital budgeting: This involves huge investments such as procurement of a new business or development in a new business. Strategic investments are exclusive and unstructured and involve simple or complex options, and they cast a significant influence on the direction and value of the business. Senior management team usually tackle such investments. Keeping the view the different decision making levels, capital expenditures could be categorized in a way, which would reflect the appropriate managerial efforts to be placed in planning and controlling them

Level of decision making:

|

|

Operating

Decision |

Administrative

Decision |

Strategic

Decision |

|

Where is the

decision taken? |

Lower level

management |

Middle level

management |

Top level management |

|

How structured is

the decision |

Routine |

Semi-structured |

Unstructured |

|

How is the level of

resource commitment |

Minor resource

commitment |

Moderate resource

commitment |

Major resource

commitment |

|

What is the time

horizon |

Short term |

Medium term |

Long term |

To summarize, Capital budgeting is described as the total process of generating, evaluating, selecting and following up on capital expenditure alternatives. The firm allocates or budgets financial resources to new Investment proposals. Normally, Capital budgeting is the procedure by which the financial manager chooses whether to invest in specific capital projects or assets. In some circumstances, the process may entail in acquiring assets that are completely new to the firm. In other situations, it may mean replacing an existing outdated asset to maintain adeptness.