Financial and Operating Leverage

Leverage is common term in financial management which entails the ability to amplify results at a comparatively low cost. In business, company's managers make decisions about leverage that affect profitability. According to James Horne, leverage is, "the employment of an asset or fund for which the firm pays a fixed cost or fixed return". When they evaluate whether they can increase production profitably, they address operating leverage. If they are expecting taking on additional debt, they have entered the field of financial leverage. Operating leverage and financial leverage both heighten the changes that occur to earnings due to fixed costs in a company's capital structures. Fundamentally, leverage refers to debt or to the borrowing of funds to finance the purchase of a company's assets. Business proprietors can use either debt or equity to finance or buy the company's assets. Use of debt, or leverage, increases the company's risk of bankruptcy. It also upsurges the company's returns, specifically its return on equity. It is a fact because, if debt financing is used rather than equity financing, then the owner's equity is not diluted by issuing more shares of stock. Investors in a business like for the business to use debt financing but only up to a point. Investors get nervous about too much debt financing as it drives up the company's default risk.

Types of leverage

There are many types of leverage. The company may use finance or leverage or operating leverage, to increase the EBIT and EPS.

Operating Leverage

The leverage related with investment activities is known as operating leverage. It is caused due to fixed operating expenses in the company. Operating leverage may be defined as the company's ability to use fixed operating costs to magnify the effects of changes in sales on its earnings before interest and taxes. Operating leverage comprises of two important costs viz., fixed cost and variable cost. Operating leverage augments changes in earnings before interest and taxes (EBIT) as a response to changes in sales when a company's operational costs are comparatively fixed. Operational leverage is the use of fixed operating costs by the firm. Operating leverage reproduces the impact on operating income of a change in the level of productivity. Operating leverage measures the extent to which a firm or specific project needs some cumulative of both fixed and variable costs. Fixed costs are amount not changed by an increase or decrease in the total number of goods or services a company produces. Variable costs can be defined as the costs that differ in direct relationship to a company's production. Variable costs rise when production upturns and fall when production drops. Businesses with higher ratios of fixed costs to variable costs are considered as using more operating leverage, while businesses with lower ratios of fixed costs to variable costs use less operating leverage. Operating leverage can be calculated with the help of the following formula:

Where,

OL = Operating Leverage

C = Contribution

OP = Operating Profits

Utilizing a higher degree of operating leverage rises the risk of cash flow problems that results from errors in forecasts of future sales. One possible effect caused by the presence of operating leverage is that a change in the amount of sales results in a "more than proportional" change in operating profit (or loss).

The degree of operating leverage (DOL) is sales profits less total variable cost divided by sales revenue less total cost:

q = quantity

p = price per unit

v = variable cost per unit

f = total fixed costs

VC = variable costs

EBIT = earnings before interest and tax

The degree of operating leverage is directly proportionate to a firm's level of business risk, and therefore it serves as a proxy for business risk.

Uses of Operating Leverage

Operating leverage is one of the procedures to measure the impact of changes in sales which lead for change in the profits of the company. If there is any change in the sales, it will lead to corresponding changes in profit.

Operating leverage assists to identify the position of fixed cost and variable cost.

Operating leverage measures the relationship between the sales and revenue of the company during a particular period.

Operating leverage helps to understand the level of fixed cost which is invested in the operating expenses of business activities.

Operating leverage defines the overall position of the fixed operating cost.

Effects of Operating Leverage

A high operating leverage entails that company has increased production without investing in additional fixed costs. As production rises, managers are in effect spreading fixed costs across a greater number of units, so the additional units have a lower ratio of fixed costs to total costs. When demand for company product increases, then experts can easily ramp up production by increasing variable costs; Company's fixed assets allow to magnify production. Managers can increase production as long as their higher variable costs do not cause total costs to exceed their sales revenues. However, at the time of a recession, high operating leverage is risky.

Financial leverage

Financial leverage characterises the relationship between the company's earnings before interest and taxes (EBIT) or operating profit and the earning available to equity shareholders. Financial leverage increases as how earnings per share (EPS) change as a result of changes in EBIT where the fixed cost is that of financing, specifically interest costs. Financial Leverage is the use of fixed financing costs by the firm. Financial leverage is attained by choice. It is used as a means of increasing the return to common shareholders (Pearson South Africa, 2007). Financial leverage mirrors the impact on returns of a change in the extent to which the firm's assets are financed with borrowed money. Financial leverage can be calculated with the help of the following formula:

Where,

FL = Financial leverage

OP = Operating profit (EBIT)

PBT = Profit before tax

The degree of financial leverage (DFL) measures a percentage change of earnings per share for each unit's change in EBIT that result from a company's changes in its capital structure. Earnings per share become more volatile when the degree of financial leverage is higher. The degree of financial leverage (DFL) is calculated as follows:

Percentage change in EPS

DFL = ---------------------------------

Percentage change in EBIT

This measure of degree of financial leverage DFL is affected by the initial earnings EBIT. This measure of financial leverage is not suitable to compare companies whose initial profits and earnings that are most certainly different, and it is also inadequate for comparisons over time for the same company.

Financial leverage expands earnings per share and returns because interest is a fixed cost. When a company's revenues and profits are on the rise, this leverage works very favourably for the company and for investors. Nevertheless, when profits are pressured or falling, the exponential effects of leverage can become challenging.

Uses of Financial Leverage: Financial leverage helps to examine the relationship between EBIT and EPS.

Financial leverage measures the percentage of change in taxable income to the percentage change in EBIT.

Financial leverage pinpoints the correct profitable financial decision regarding capital structure of the company.

Financial leverage is vital devices which is used to measure the fixed cost proportion with the total capital of the company.

If the firm obtains fixed cost funds at a higher cost, then the earnings from those assets, the earning per share and return on equity capital will decrease.

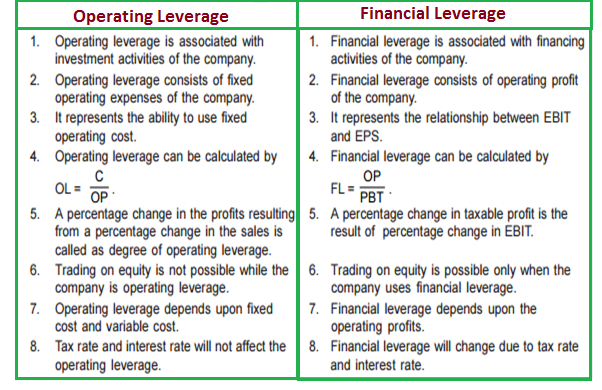

There is a difference between operation and financial leverages:

Combined leverage: When the company utilizes both financial and operating leverage to amplification of any change in sales into a larger relative changes in earning per share. Combined leverage is also known as composite leverage or total leverage. Combined leverage shows the relationship between the revenue in the account of sales and the taxable income.

Combined leverage can be calculated with the help of the following formulas:

Where,

CL = Combined Leverage

OL = Operating Leverage

FL = Financial Leverage

C = Contribution

OP = Operating Profit (EBIT)

PBT = Profit Before Tax

Degree of Combined Leverage:

The percentage change in a firm's earning per share (EPS) results from one percent change in sales. This is also equal to the firm's degree of operating leverage (DOL) times its degree of financial leverage (DFL) at a particular level of sales.

To summarize, Operating leverage is the degree to which a firm's fixed production costs contribute to its total operating costs at different levels of sales. In a firm that has operating leverage, a given change in sales results in major change in the net operating revenue. Financial leverage calculates the sensitivity of the firm's net income to changes in its net operating income (NOI). On the contrary to operating leverage, which is determined by the firm's choice of technology (fixed and variable costs), financial leverage is dogged by the firm's financing selections (the mix of debt and equity).