Preparing the Financial Statements

Financial statements in financial document used to indicate the financial position of a business at particular moment of time. The statement is prepared at the end of each financial year using accounting basis (Zoan NG, 2014).

Several management experts have emphasized that Understanding financial statements is necessary for triumph of a small business. Financial statements are all interlinked, and have some dependencies on the other statements. They are generally prepared in the following order:

- Profit and loss account / Income statement

- Statement of retained earnings / changes in equity

- Balance sheet

- Cash flow statement

- Financial Statement Analysis

- File Financial Statement Reports

The profit and loss account include thorough details of the company's revenues, expenses and tax costs, which are used to generate an overall profit figure for the company. As such, it includes information from all revenue and expense accounts, as well as any capital gains or losses made over the accounting period and any adjusting entries.

The statement of retained earnings reveals the profits earned by the company, or losses made, have been retained in the company as shareholder's equity. Companies can boost the value of their shareholder's equity through making profits. The retained earnings are made up of the company's net profits, less any earnings distributed to shareholders in the form of dividends. Consequently, in order to prepare the statement of retained earnings company's simply take their previous level of retained earnings, add their net revenue and subtract any dividends paid out and the value of any share repurchases.

The balance sheet is important part of financial statement. It gives clear picture of the company's assets, liabilities and shareholders' equity, as per the accounting equation. As such, it is prepared by adding the balance of all asset accounts to create the total assets figure, adding all liability accounts to create the total liabilities figure, then adding the capital stock balance and the retained earnings balance to create the total shareholders' equity figure. The total assets figure should be equal to the sum of the total liabilities and the total shareholders' equity, according to the accounting equation.

A balance sheet is an extended form of the accounting equation. An accounting equation is:

Assets = Liabilities + Equity

The balance sheet, also known as the statement of financial position, is financial statement prepared during the accounting cycle. The balance sheet reports a company's financial status based on its assets, liabilities, and equity at a single moment in time. It is dissimilar to the income statement and does not report activities over a huge time frame. The balance sheet is essentially a representation a company's recourses, debts, and ownership on a given day. In this way, the balance sheet is sometimes considered less trustworthy of a company's present financial performance. Annual income statements look at performance over the course of 12 months, whereas, the balance sheet only concentrates on the financial position of one day. The balance sheet is essentially a report version of the accounting equation and also termed as the balance sheet equation where assets always equate liabilities plus shareholder's equity. In this manner, the balance sheet demonstrates how the resources controlled by the business (assets) are financed by debt (liabilities) or shareholder investments (equity). Shareholders and creditors generally visualize the statement of financial position for awareness as to how efficiently a company can utilize its resources and how successfully it can finance them.

This statement can be reported in two different formats that include account form and report form. The account form comprises of two columns that show assets on the left column of the report and liabilities and equity on the right column. The debit accounts are presented on the left and credit accounts are on the right. The report form only has one column. This form is considered as a traditional report that is issued by companies. Assets are always present first followed by liabilities and equity. In both formats, assets are classified into current and long-term assets. Current assets include resources that will be used in the current year, whereas long-term assets are resources lasting longer than one year. Liabilities are also separated into current and long-term categories. Like all financial statements, the balance sheet has a headline that display's the company name, title of the statement and the time period of the report.

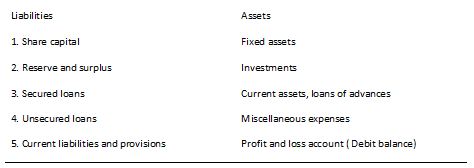

Major headings of balance sheet:

The cash flow statement is exclusive amongst the financial statements, in that it does not actually reveal any change in the value of the company. Instead, it simply gives details about changes have occurred to the company's cash balance over the years. However, as most companies go bankrupt due to a lack of cash flow to pay expenses and debts, the cash flow statement has distinct role in accounting arena.

The cash flow statement is solely based on the cash held by the company. It cannot be produced from the ledger accounts, as these will include accruals and deferrals. Consequently, it must be derived from available information in one of two ways. The company can either use its net income figure, adding or subtracting noncash items from it, or the company can just generate a cash flow statement from all its cash receipts and payments.

Financial Statement Analysis: Though Business possessors are not in need of all the details, but they certainly want to understand the huge part of their current financial position and cash position. These insights are critical to make important decisions to operate business.

File Financial Statement Reports: All companies, foreign and domestic, are required to file registration statements, periodic reports, and other forms electronically through the Electronic Data Gathering, Analysis, and Retrieval system (EDGAR). EDGAR is a system developed to automate the filing, processing and dissemination of some 125 million pages of registration statements, reports and other filings received by the SEC each year. The rationale of EDGAR is to boost the efficiency and justice of the securities market for the benefit of shareholders, companies, and the economy through time-sensitive collection tool. The major processes of the electronic filing life cycle supported by EDGAR are the following:

- Preparation and submission by filers;

- Receipt and acceptance by SEC;

- Data storage and retrieval;

- Data dissemination to the public; and

- Analysis and review by SEC staff.

Preparation

Financial statements preparation can be effortless or it may be intricate. It totally depends on the size of the company. Some statements need footnote disclosures while other can be presented without any. Particulars like this generally depend on the intention of the financial statements. Financial statements are prepared by transferring the account balances on the adjusted trial balance to a set of financial statement templates.

To summarize, financial statements are reports prepared and issued by corporations to provide valuable financial information to investors and creditors about a company's performance and financial standings. The primary purpose of financial accounting is to provide useful financial information to users outside of the company.