Financial Accounting

Accounting is described as the language of the business. Financial accounting is important branch of accounting. Financial Accounting is associated with recording, classifying and summarizing financial transactions and preparing statements relating to the business according to generally accepted accounting concepts and conventions. It is mainly intended to aid all parties external to the operating responsibility of company such as shareholders and creditors besides providing information about the overall operational results of the business.

Concept of financial accounting: In general way, financial accounting is the statement of information about a business or other type of organization so that executives or staff can assess its financial growth and future results. The purpose of financial accounting is to ascertain the results (profit or loss) of business operations during the particular period and to state the financial position (balance sheet) as on a date at the end of the period.

Financial accounting is based upon the accounting equation.

Assets = Liabilities + Owners' Equity

This is a mathematical equation which must balance. In this assets are valuable resource that are owned by firm. They represent probable future economic benefit and arise as result of past transactions or events. Liabilities are present obligations of the firm. They are probable future sacrifices of economic remunerations which arise as the result of past transactions or events. Owners' equity signifies the owners' residual interest in the assets of the business. Residual interest is another name for owners' equity. Owners may make a direct investment in the business or operate at a profit and leave the profit in the business.

In management literature, it is thoroughly represented that financial accounting incorporates the rules and procedures to express financial information about an organization. Individuals who achieve high level knowledge of financial accounting can utilize this information to take vital decisions based on the organization's perceived financial health and viewpoint. Such decisions might include evaluating employment potential, lending money, granting credit, and buying or selling ownership shares.

Financial accountancy is directed by both local and international accounting standards. Generally Accepted Accounting Principles is the standard framework for guidelines for financial accounting used in any given jurisdiction. It encompasses the standards, conventions and rules that accountants follow in recording and summarising and in the preparation of financial statements. Conversely, International Financial Reporting Standards is a set of international accounting standards stating how particular types of transactions and other events should be reported in financial statements.

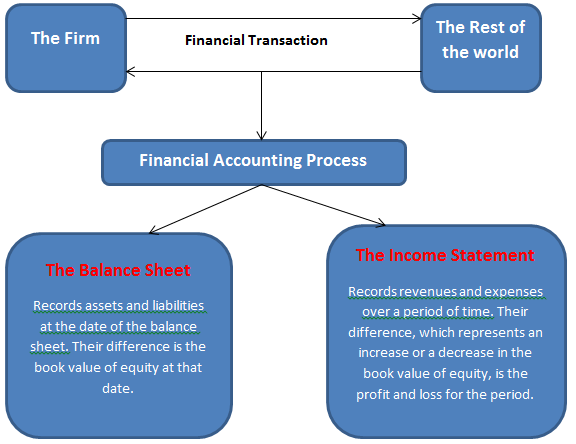

Financial accounting process

Basic features of financial accounting are as under:

Relevance: Financial accounting is decision-specific. It must be possible for accounting information to influence decisions. This trait is important for developing statements.

Materiality: Information is material if its error or misstatement could influence the economic decisions of users taken on the basis of the financial statements.

Reliability: Accounting must be precise or unbiased. It should be capable to be relied upon by managers. Often information that is highly relevant isn't very reliable, and vice versa.

Understandability: Accounting reports should be clearly understood to accountant and by those at whom the information is aimed.

Comparability: Financial reports from different periods should be comparable with one another in order to derive meaningful conclusions about the trends in an entity's financial performance and position over time. Comparability can be ensured by applying the same accounting policies over time.

Scope of financial accounting: Financial accounting system gives summarized and categorized information about the performance of organization and its state of affairs mainly for external decision makers. It provides information how companies are doing, whether these are earning profit. The main objective of Financial Accounting is to prepare profit and loss account and balance sheet for reporting to owners and outside parties (Bhar, 1976). It is intended to offer useful information through preparing general purpose reports to investors, creditors, and other users in making good investments and economic decisions. These are general purpose reports which provide information on management performance to judge its effectiveness in utilising recourse and running of enterprise (Jawahar Lal, 2009).

The end product of financial accounting system is financial statements that give valuable information to decision makers such as profit and loss account. The accounting techniques used in financial accounting depends on the notion of double entry system. Financial accounting measures general business transactions, economic resources, financial obligations and change in them in terms of monetary units of society in which it operates (Jawahar Lal, 2009). Management use financial statements for internal purpose. They analyse financial statement for decision making that affect the financial status of firm (Kimuda, 1986).

Importance of finance accounting: Financial accounting, is important for all types of companies. For small-business owners, the importance of financial accounting sometimes is unnoticed. Financial accounting is useful for the recording of transactions. This function of accounting is also known as bookkeeping. Small companies use financial accounting to record business activity in the company's ledger. Because financial accounting uses the double-entry system, each transaction affects two accounts, representing the two sides to a transaction.

All small-business owners adopt accounting procedure to keep a record of the business activities. This is done in a ledger. Financial accounting uses the double-entry method. This is nothing new as every transaction affects to sides. Consequently, the double-entry system affects two accounts. This provides a clear and methodological approach into the activities of the business. In this sense, financial accounting is extremely beneficial. Information is communicated to outside parties through financial accounting. These are people who are not directly involved in the business, but are interested in the operations of business. This is done by providing the outside parties with financial statements of the business. These are the final results of how business transactions were conducted. Financial statements compare the growth of the business and weigh it against their expectations of the business. This enables them to form an idea of how the business is progressing.

There are grounds to elucidate the significance of financial accounting. Financial accounting is also vital for the communication of information for those within the business too. These are known as internal users. Financial accounting is useful for organizations as it provides small-business owners the ability to analyse their competitors and also to evaluate various investment opportunities. The rules of financial accounting are common for every business. Every business uses the same method of analysis and this makes it easier for business owners to compare different businesses against one another. As it is a standard method of analysis, small business owners are able to get a ratio of the businesses and use this ratio to compare rivals.

Advanced Financial Accounting, with the social and economic development, financial accounting for the original content to supplement, extend and develop an accounting, that is intrinsic in the use of financial accounting methods, financial accounting does not include the existing business, as well as objective changes in economic environment, some of the special business to generate new ideas to reflect the accounting and supervision of accounting. With accounting principles, intermediate financial accounting complement each other, together form a complete financial accounting system.

Drawbacks of Finance Accounting

First disadvantage of financial accounting is that it allows alternative treatments. Undoubtedly, accounting is based on concepts and it follows "generally accepted accounting principles", but there exist more than one principle for the treatment of any one item. This permits alternative treatments within the framework of generally accepted accounting principles.

Secondly, financial accounting is impacted by personal judgements in spite of the fact that convention of objectivity is respected in accounting but to record certain events estimates have to be made which requires personal judgement. It is very difficult to expect precision in future estimates and objectivity suffers.

Another demerit of financial accounting is that it overlooks important non-monetary information. Financial accounting takes into consideration only those transactions and events which can be labelled in money. The transactions and events, however important, if non-monetary in nature are ignored i.e., not recorded.

Financial accounting does not give information on time. Financial accounting is designed to supply information in the form of statements (Balance Sheet and Profit and Loss Account) for a period, normally, one year. So the information is of historical interest and only post-mortem analysis of the past can be conducted. The business requires timely information at frequent intervals to enable the management to plan and take corrective action.

Financial accounting does not offer comprehensive analysis. The information supplied by the financial accounting is in reality aggregate of the financial transactions during the course of the year. Of course, it enables to study the overall results of the business activity during the accounting period. For proper operation of the business, the information is required regarding the cost, revenue and profit of each product but financial accounting does not provide such detailed information product-wise.

Financial accounting does not reveal the present value of the business. In financial accounting, the position of the business as on a particular date is shown by a statement known as balance sheet. In balance sheet the assets are shown on the basis of going concern concept. Therefore, it is presumed that business has comparatively longer life and will continue to exist indefinitely, hence the asset values are going concern values. The realised value of each asset if sold today cannot be identified by studying the balance sheet.

To summarize, financial accounting are basically, financial statements means of communicating financial information to parties outside the business organization. Financial accounting is a subsection of accounting in which money is seen as a device to gauge financial performance. Financial accounting includes the monitoring and controlling of the flow of money into and out of a company. Those flows are documented on financial statements such as the balance sheet, income statement and cash flow statement which provide insightful information to external parties who have a vested interest in the company's performance. This includes lenders and investors. Various studies have shown that financial accounting is a system that amasses, processes and reports information about an entity's performance (i.e. profit or loss), its financial position (i.e. assets, liabilities and shareholders' equity) and changes in financial position. Main intent of financial accounting is preparation of general purpose financial statements, which are financial statements meant for use by stakeholders, external to the entity, who do not have any other means of getting such information.