Industry Analysis

An industry analysis is significant business function which is performed by business proprietors and other management experts to evaluate the present business environment. This is considered as effective market assessment tool designed to provide a business with an idea of the intricacy of a particular industry. Industry analysis reviews the economic, political and market factors that influence the way the industry develops. Major factors can include the power manipulated by suppliers and buyers, the condition of competitors, and the possibility of new market entrants.

In management literature, an Industry is defined as a homogenous group of companies or group of firms that manufacture similar products which serves the same requirements of common set of purchasers. Industry analysis is explained as an evaluation of the relative strengths and imperfections of specific industries. Industries are conventionally categorised on the basis of products like steel, pharmaceutical oil and gas industries, textile, and cement.

Industry analysis assists businesses to comprehend many economic factors of the marketplace and how these factors may be tactfully used to gain a competitive advantage. Although business possessors may conduct an industry analysis according to their particular needs, a few basic standards exist to perform this important business function. Small business owners often conduct industry analysis before starting their business. This analysis is included in the entrepreneur�s business plan that summaries specific components of the economic marketplace. Elements may include the number of competitors, availability of substitute goods, target markets and demographic groups or various other pieces of essential business information. This information is usually used to secure external financing from banks or lenders for starting a new business venture. According to management theorists, an industry analysis consists of three major elements:

1. The underlying forces at work in the industry

2. The overall attractiveness of the industry

3. The critical factors that determine a company's success within the industry.

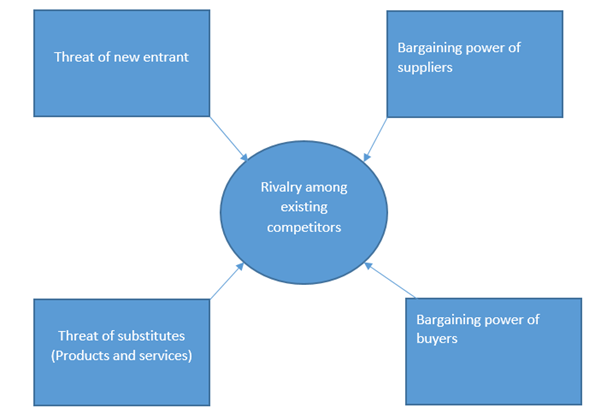

Porter's Five Forces Analysis

The primary model to assess the structure of industries was developed by famous management theorist, Michael E. Porter in his 1980 book Competitive Strategy: Techniques for Analyzing Industries and Competitors. Porter's model demonstrations that rivalry among firms in industry depends upon five forces: the potential for new competitors to enter the market; the bargaining power of buyers and suppliers; the availability of substitute goods; and the competitors and nature of competition. Main purpose of Five Forces is to determine the attractiveness of an industry. However, the analysis also provides basis for articulating strategy and understanding the competitive scene in which a company operates.

Porter�s Five Forces for industry analysis:

The framework for the Five Forces Analysis consists of these competitive forces:

1. Industry rivalry (degree of competition among existing firms): Tough competition leads to reduced profit potential for companies in the same industry. In competitive industry, firms have to compete fiercely for a market share, which results in low profits. Rivalry among competitors is tough when:

1. There are many competitors;

2. Exit barriers are high;

3. Industry of growth is slow or negative;

4. Products are not differentiated and can be easily substituted;

5. Competitors are of equal size;

6. Low customer loyalty.

2. Threat of substitutes (products or services): Availability of substitute products will limit company�s ability to increase prices. This force in Porter�s model is especially threatening when buyers can easily find substitute products with attractive prices or better quality and when buyers can switch from one product or service to another with low price.

3. Bargaining power of buyers: Powerful consumers have a substantial impact on prices. Consumers have power to demand high quality or low priced products. If the price of the product is low, it directly impact in the revenue of producers. While higher quality products usually raise production costs. In both situations, there is less profit for producers. Buyers exert strong bargaining power when:

1. Buying in large quantities or control many access points to the final customer;

2. Only few buyers exist

3. Switching costs to other supplier are low

4. They threaten to backward integrate

5. There are many substitutes

6. Buyers are price sensitive

4. Bargaining power of suppliers: powerful suppliers can demand premium prices and limit profit of company. Porter stated that strong bargaining power permits suppliers to sell higher priced or low quality raw materials to their consumers. This directly affects profit of the buying firms because it has to invest more for materials. Suppliers have strong bargaining power in following conditions: There are few suppliers but many buyers;

1. Suppliers are large and threaten to forward integrate;

2. Few substitute raw materials exist;

3. Suppliers hold scarce resources;

4. Cost of switching raw materials is especially high.

5. Barriers to entry (threat of new entrants): It acts as a deterrent against new competitors. This force decides how easy (or not) it is to enter a particular industry. If an industry is lucrative and there are few barriers to enter, rivalry soon deepens. When more organizations compete for the same market share, there is less profit. It is crucial for existing organizations to generate high barriers to enter to prevent new entrants. Threat of new entrants is high when:

1. Low amount of capital is required to enter a market;

2. Existing companies can do little to retaliate;

3. Existing firms do not possess patents, trademarks or do not have established brand reputation;

4. There is no government regulation;

5. Customer switching costs are low (it doesn�t cost a lot of money for a firm to switch to other industries);

6. There is low customer loyalty;

7. Products are nearly identical;

8. Economies of scale can be easily achieved.

Steps in Industry analysis:

1: Identify industry and provide a brief overview. Management team may need to explore industry from a variety of geographical considerations: locally, regionally, provincially, nationally, and globally. It is necessary to define relevant industry codes. Provide statistics and historical data about the nature of the industry and growth potential for business, based on economic factors and conditions.

2: Secondly, evaluators must summarize the nature of the industry. This process include specific information and statistics about growth patterns, fluctuations related to the economy, and income projections made about the industry. It is important to document recent developments, news, and innovations. Evaluators must discuss the marketing strategies, and the operational and management trends that are predominant within the industry.

3: Third step is to provide a forecast for industry. Managers must compile economic data and industry predictions at different time intervals. It is necessary to cite all of sources. Note: the type and size of the industry will determine how much information company will be able to find about a particular industry.

4: Industry analysts needs to identify government regulations that affect the industry. They must include any recent laws pertaining to industry, and any licenses or authorizations company would need to conduct business in target market.

5: Industry analysts have to explain unique position within the industry. After completing competitive Analysis, analysts can list the leading companies in the industry, and compile an overview of data of direct and indirect competition. This will support them communicate unique value plan.

6: Industry analysts must list potential limitations and risks. They should write about factors that might negatively impact their business and they predict in the short-term and long-term future. They must outline what they know about the driving forces such as new regulations, technology, globalization, competitors, changing customer needs.

7: Industry analysts needs to talk to people by visiting to tradeshows and go to business events.

Industry analysis allows firms to develop a competitive policy that best protects against the competitive forces or influences them in its favour. The key to developing a competitive strategy is to understand the sources of the competitive forces. By developing an understanding of these competitive forces, firm can:

I. Highlight the company�s critical strengths and weaknesses (SWOT analysis)

II. Animate its position in the industry

III. Explain areas where strategic changes will result in the greatest payoffs

IV. Highlight areas where industry trends designate the greatest importance as either opportunities or threats.

The importance of industry analysis:

A broad industry analysis necessitates a small business owner to take an impartial view of the primary forces, attractiveness, and success factors that define the structure of the industry. Firms must comprehend its operating environment to formulate an effective strategy, position the company for success, and make effective use of the limited resources of the small business. According to Porter, "Once the forces affecting competition in an industry and their fundamental causes have been identified, the firm is in a position to recognise its strengths and weaknesses relative to the industry".

An effective competitive strategy takes offensive or defensive action in order to produce a secure position against the five competitive forces. Some strategies include positioning the firm to use its unique capabilities as defence, influencing the balance of outside forces in the firm's favour, or anticipating shifts in the underlying industry factors and adapting before competitors do in order to gain a competitive advantage. In nutshell, industry analysis provides a basis upon which analysts evaluate and decide about their corporate goals and it helps them develop insight into developing appropriate strategies.

Major success factors for industry analysis:

1. Ability to appeal new customers

2. Ability to hold existing customers

3. Ability to attract and retain good employees

4. Successful advertising campaigns (success is measured on the increase in sales)

5. Managing service or product

6. Managing human resources

7. Managing cash flow

8. Managing revenue growth and profit

9. Utilization of operating capacity

10. Strong distribution channels

11. Low cost production structure

12. Strong technology capability

13. Location to customers

14. Sustainability of the business

To summarize, industry analysis is a feasible procedure that enables company to understand its status relative to other companies that produce alike products or services. It is a systematic process of gathering and analysing, information about industry on a global and domestic basis. Factors include economics, trends, social and political factors, and changes in technology, and the rate of change. If company understand the forces at work in the overall industry, then it will help to formulate strategies, and do strategic planning. Industry analysis empowers small business owners to recognise the threats and opportunities facing their businesses, and to focus their resources on developing unique capabilities that could lead to a competitive advantage. There are five forces developed by popular theorist Porter which help to conduct efficient industry analysis and enable company to gain competitive advantage.