Relevant Costing and Costing for Decision Making

In management accounting, notion of relevant costing has great significance because these costs are pertinent with respect to a particular decision. A relevant cost for a particular decision is one that transforms if an alternative course of action is taken. Relevant costs are also termed as differential costs. Studies have demonstrated that relevant costs will make a difference in a decision. A relevant cost only relates to a particular management decision and which will alter in the future as a result of that decision. Other theorists described that relevant costs are future costs that will differ among alternatives. The main intent of relevant costing is to determine the objective cost of a business decision. An objective measure of the cost of a business decision is the degree of cash outflows that shall result from its execution. Relevant costing focuses on just that and overlooks other costs which do not influence the future cash flows. The fundamental principles of relevant costing are quite simple and managers can perhaps relate them to personal experiences involving financial decisions.

It is stated in theoretical literature that relevant costing is a management accounting toolkit that assists management team to make decisions when they have to deal with some issues such as whether to buy a component from an external vendor or manufacture it in house?, Whether to accept a special order?, What price to charge on a special order?, Whether to discontinue a product line?, How to utilize the scarce resource optimally?. CIMA describes relevant costs as: "the costs appropriate to a specific management decision". A study of relevant costs and benefits assists to take wise decision. In order to meet the criteria for relevancy, a cost must have two criteria that include they affect the future and they differ among alternatives. Other group of theorists asserted that the relevant costs are applicable to decision. Costs are relevant, if they direct the executive towards the decision. It will be useful, if the costs are not only relevant but also precise. Relevance and accuracy are not alike concepts. Costs may be correct and irrelevant, costs may be incorrect but it can be relevant (Varshney, 2008).

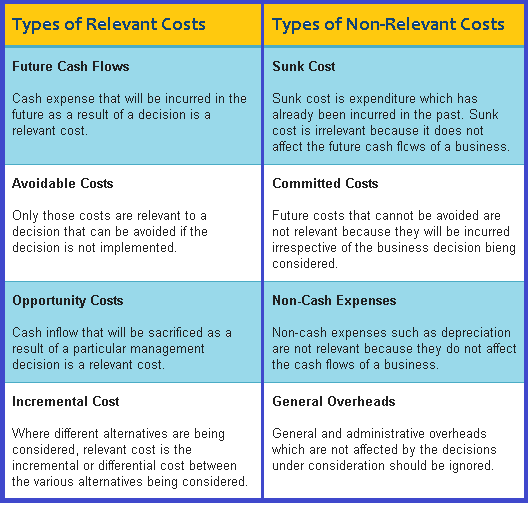

Relevant information is the predicted future costs and incomes that will differ among the alternatives relevant information (Horngren, et al, 2006). Relevant costs are the costs which would change as a result of the decision under consideration, where as irrelevant costs are those which would remain unchanged by the decision. Therefore only relevant cost would be included in the investigative framework (Khan and Jain, 2008). A relevant cost is also defined as a cost whose amount will be affected by a decision being made. Management should believe only future costs and revenues that will differ under each alternative (Arora, 2008). Relevant costs are accepted future costs and relevant profits are expected future revenues that differ among the alternative course of action being considered (Hongren and Datar, 2008). In the arena of Management accounting, one feature of relevant cost is that they are future costs which have not been incurred. Hence the cost of material is relevant cost as long as the material not purchased because of deciding whether or not to purchase the material, one is to decide to sustain the cost or evade it. Therefore, all relevant costs are future costs. Whether particular costs and profits are relevant for decision making depends on decision circumstance and the options available. When selecting among different alternatives, manager must focus on the costs and revenues that differ across the decisions alternatives; these are relevant cost/revenues (Atkinson, et al, 2008). The relevance of cost to decision alternative is determined by situation. The facts and policies explain situation. It is established that historical cost is not relevant, only future cost is relevant. All sunk costs are irrelevant (Allied Publishers, 1997).

The following are relevant Costs:

Differential cost: A differential cost is the difference in cost items under two or more decision alternatives distinctively two different projects or situations. Where same thing with the same amount appears in all alternatives, it is irrelevant. Differential costs must be compared to differential revenues.

Incremental or marginal cost: Relevant costing is an incremental investigation which indicates that it considers only relevant costs that is costs that vary between alternatives and ignores sunk costs that is costs which have been incurred, which cannot be changed and therefore are inappropriate to the business situation. Incremental or marginal cost is a cost linked with producing an additional unit.

Incremental cost must be compared with incremental revenues to take decision.

Opportunity cost: It is cost of opportunity foregone. Whenever an organization decides to go for a particular project, it should not overlook opportunities for other projects. It should consider what alternative opportunities are there and which the best of these alternative opportunities is.

Irrelevant costs: The reverse of a relevant cost is a sunk cost. A sunk cost is an expense that has already been made, and so will not change on a go-forward basis. Sunk costs are past costs. These cannot be changed with any future decision. Similarly, a cost which is identical in all decisions is immaterial.

Importance and usefulness: The notion of the relevant cost is very helpful to eliminate irrelevant information from a particular decision-making process. Also, by eliminating irrelevant costs from a decision, management is prevented from focusing on information that might inaccurately affect its decision. The relevant cost is only applicable to management accounting activities and this notion is not applicable in financial accounting, as no spending decisions are involved in financial accounting. Whereas relevant costing is a functional tool in short-term financial decisions, it would possibly not be sensible to form it as the foundation of all pricing decisions because in order for a business to be sustainable in the long-term, it should charge a price that provides enough profit margin above its total cost and not just the pertinent cost.

There are numerous examples of use of relevant costing such as

- Competitive pricing decisions

- Make or buy decisions

- Further processing decisions

When company is willing to take long term financial decisions such as investment appraisal, disinvestments and shutdown decisions, relevant costing is not suitable because most costs which may seem non-relevant in the short term become preventable and incremental when considered in the long term. Though, even long term financial decisions such as investment assessment may use the fundamental principles of relevant costing to make easy an objective appraisal.

Limitation of relevant costing: There are many limitations of relevant costing:

If the correct and accurate results are to be obtained, then proper thought has to be given to the matter. Each cost item apparent or hidden needs proper attention before assumption are built in the solution. It is not proper to proceed on the assumption in the context of relevant costing. The cost so indicated on the relevant cost statement is valid only at a given level of activity. Experts stated that in relevant costing, period of comparison is often incomplete or incomparable. Timing of cost and benefit is not important in the technique of relevant costing. On the contrary, the financial analyst considers the cash flow along with the timing of it. The consideration of time factors allows the discontinuation in the cash flow in financial management theories. Relevant costing suffers the limitation on this count but serves the practical objective of profit. Another issue in relevant costing is handling the opportunity cost. The difficulty of estimating opportunity cost can be temporarily overcome by extending relevant costing solution into the calculation of accounting rate of return. It is also termed as average rate of return. A return as a percentage of investment is calculated (Allied Publishers, 1997).

To summarize, decision making is an integral part of any business of human life. But business life presupposes the conscious level of decision making instead of rash decision. Before taking the decision, managers must identify the variables that may have bearing on the decision and try to get information about those variables. Relevant cost, in managerial accounting, denotes to the incremental and unnecessary cost of implementing a business decision. Relevant cost analysis is a cost accounting based evaluation technique. It is just an improved application of basic principles to business decisions. The major factor in relevant costing is the capacity to clean what is and is not pertinent to a business choice. This technique is applicable to all special or non-routine situations.