Corporate governance

Corporate governance is the structure and the associations which govern corporate direction and performance. The board of directors have dominant role in corporate governance. Its relationship to the other primary participants, typically shareholders and management, is critical. Other members include employees, customers, suppliers, and creditors. The corporate governance framework also depends on the legal, regulatory, institutional and ethical environment of the community. Usually, corporate governance is described as the host of legal and non-legal principles and practices affecting control of publicly held business firms. Broadly speaking, corporate governance affects not only who controls publicly traded corporations but also the allocation of risks and returns from the firm's activities among the various contributors in the firm, including stockholders and managers as well as creditors, employees, customers, and even societies.

Concept of governance:

Many management scholars have recognized that strong corporate governance is vital to resilient and vibrant capital markets and is an important tool of investor protection. According to The Institute of Company Secretaries of India, “Corporate Governance is the application of best management practices, compliance or jaw in true letter and spirit and adherence to ethical standards for effective management and distribution of wealth and discharge of social responsibility for sustainable development of all stakeholders”. Cadbury Committee (U.K.), 1992 has defined corporate governance as “Corporate governance is the system by which companies are directed and controlled. It encompasses the entire mechanics of the functioning of a company and attempts to put in place a system of checks and balances between the shareholders, directors, employees, auditor and the management." Other group of scholars explained the term corporate governance as “process and structure by which the business and affairs of the company are directed and managed in order to enhance long term shareholder value through enhancing corporate performance and accountability, whilst taking into account the interests of other stakeholders".Firms at global level recognising that better corporate governance adds substantial value to their operational performance in the following ways:

- It improves strategic thinking at the top by inducting independent directors who bring a wealth of experience, and a host of new ideas.

- It justifies the management and monitoring of risk that a firm faces globally.

- It limits the responsibility of senior management and directors, by carefully articulating the decision making process

- It assures the integrity of financial reports.

- It has long term reputational effects among main stakeholders, both internally and externally.

Objective of corporate governance:

The fundamental objective of corporate governance is to boost and maximize shareholder value and protect the interest of other stake holders. World Bank described Corporate Governance as blend of law, regulation and appropriate voluntary private sector practices which enables the firm to attract financial and human capital to perform efficiently, prepare itself by generating long term economic value for its shareholders, while respecting the interests of stakeholders and society as a whole. Corporate governance has various objectives to strengthen investor's confidence and intern leads to fast growth and profits of companies. These are mentioned below:- A properly structured Board proficient of taking independent and objective decisions is in place at the helm of affairs.

- The Board is balanced as regards the representation of suitable number of non-executive and independent directors who will take care of the interests and well-being of all the stakeholders.

- The Board accepts transparent procedures and practices and arrives at decisions on the strength of adequate information.

- The Board has an effective mechanism to understand the concerns of stakeholders.

- The Board keeps the shareholders informed of relevant developments impacting the company.

- The Board effectively and regularly monitors the functioning of the management team.

- The Board remains in effective control of the affairs of the company at all times.

Elements of good Corporate Governance:

It has been established in various management reports that aspects of good corporate governance comprise of transparency of corporate structures and operations, the accountability of managers and the boards to shareholders, and corporate responsibility towards stakeholders. While corporate governance basically lays down the framework for creating long-term confidence between companies and the external providers of capital.There are numerous elements of corporate governance which are mentioned below:

- Transparency in Board's processes and independence in the functioning of Boards. The Board should provide effective leadership to the company and management to realize sustained prosperity for all stakeholders. It should provide independent judgment for achieving company's objectives.

- Accountability to stakeholders with a view to serve the stakeholders and account to them at regular intervals for actions taken, through strong and sustained communication processes.

- Impartiality to all stakeholders.

- Social, regulatory and environmental concerns.

- Clear and explicit legislation and regulations are fundamentals to effective corporate governance.

- Good management environment that includes setting up of clear objectives and suitable ethical framework, establishing due processes, clear enunciation of responsibility and accountability, sound business planning, establishing clear boundaries for acceptable behaviour, establishing performance evaluation measures.

- Explicitly approved norms of ethical practices and code of conduct are communicated to all the stakeholders, which should be clearly understood and followed by each member of the organization.

- The objectives of the corporation must be clearly recognized in a long-term corporate strategy including an annual business plan along with achievable and measurable performance targets and milestones.

- A well composed Audit Committee to work as liaison with the management, internal and statutory auditors, reviewing the adequacy of internal control and compliance with significant policies and procedures, reporting to the Board on the key issues.

- Risk is an important component of corporate functioning and governance, which should be clearly acknowledged, analysed for taking appropriate corrective measures. In order to deal with such situation, Board should formulate a mechanism for periodic reviews of internal and external risks.

- A clear Whistle Blower Policy whereby the employees may without fear report to the management about unprincipled behaviour, actual or suspected frauds or violation of company's code of conduct. There should be some mechanism for adequate safeguard to personnel against victimization that serves as whistle-blowers.

USA Corporate Governance legislation/regulation:

The Sarbanes-Oxley Act of 2002 is generally reflected the first major Corporate Governance legislative measure in the USA. It is also known as the ‘Public Company Accounting Reform and Investor Protection Act' and ‘Corporate and Auditing Accountability and Responsibility Act' the legislation is also known informally as Sarbanes-Oxley, Sarbox or SOX. The act is named after its instigators: Senator Paul Sarbanes and Representative Michael G Oxley. As in the UK, legislative pressures developed from the uproar by media, public and politicians in response to corporate outrages, specifically and particularly the criminal and vast failures in the late 1900s and early 2000s of Enron, Tyco, and WorldCom, which caused losses of $billions for investors, and severely undermined US economic stability, and in other major markets too. The significant Sarbanes-Oxley Act became federal law aimed to set standards for public company boards of directors, management, and the accounting firms responsible for auditing public companies.The act primarily:

Increased the responsibility of management to certify accuracy of financial information.

Increased penalties for corporate fraud.

Increased necessary independence of auditors.

Increased the formal legal responsibility of corporate boards of directors for the oversight of their corporations' activities, decision-making and accounting.

EU Corporate Governance legislation/regulation:

In the late 1900s and early 2000s, The European Union specialists tended to encourage member states to develop their own Corporate Governance standards and regulatory instruments, rather than intercede directly or produce mandatory standards. Differences in national corporate laws - especially concerning company incorporation and investors are naturally difficulties to the development of Europe-wide Corporate Governance rules.

Various laws, codes, and institutional bodies became established across Europe on an individual nation basis to address Corporate Governance. These instruments continued to be refined through the 2010s and will extend to 2020s, until standards of Corporate Governance, and mechanisms for compliance/monitoring/remedial action, are established effectively in response to the challenging dynamics of globalized commerce. The inability through the 2010s of international governments to counter large-scale corporate tax avoidance accounting schemes is a prime example of how globalized business is several steps ahead of globalized regulatory control. During the early 2000s and 2010s, EU commissioners began to produce reports, codes, and guidelines aimed at influencing and coordinating Corporate Governance regulations and instruments at national level.

EU interest and (non-enforceable) guidance during this period focused primarily on:

- Directors' remuneration

- Non-executive director's selection and appointment

- Auditing

- Corporations' commitment and adherence to transparent published statements of Corporate Governance

Review of corporate governance in India:

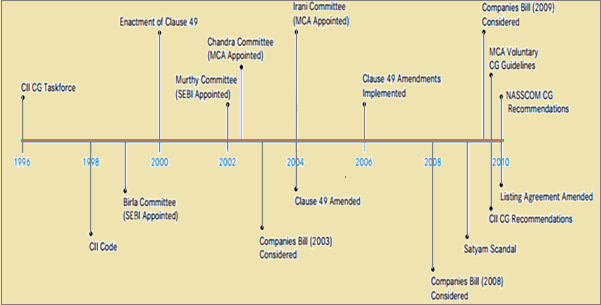

The notion of corporate governance has been incepted with major objective of significant disclosure of information to the shareholders. Since then, corporate governance has steered the Indian companies. As the time changed, there was also need for greater accountability of companies to their shareholders and customers. The report of Cadbury Committee on the financial aspects of corporate Governance in the U.K. has given rise to the discussion of Corporate Governance in India. Corporate governance has been since olden times but it was in different form. During Vedic times, kings used to have their ministers and used to have ethics, values, principles and laws to run their state but today it is in the form corporate governance having same rules, laws, ethics, values, and morals which helps in running corporate bodies in the more effective ways so that they in the age of globalization become global giants.There have been numerous corporate governance initiatives launched in India since the mid-1990s. The first was by the Confederation of Indian Industry (CII), India's major industry and business association, which emerged with the first voluntary code of corporate governance in 1998. The second was by the SEBI, now enshrined as Clause 49 of the listing agreement. SEBI in 2000 introduced unparalleled corporate governance reforms via Clause 49 of the Listing Agreement of Stock Exchanges. Clause 49, a seminal event in Indian corporate governance, established a number of governance requirements for listed companies with a focus on the role and structure of corporate boards, internal controls and disclosure to shareholders. The third was the Naresh Chandra Committee, which submitted its report in 2002. The fourth was again by SEBI the Narayana Murthy Committee, which also submitted its report in 2002.

Corporate Governance Development in India: A Timeline

India's corporate governance reform efforts did not stop after implementation of Clause 49. In January 2009, the Indian corporate community was astounded by enormous accounting scandal involving Satyam Computer Services (Satyam), one of India's largest information technology companies. As a result of the scandal, Indian regulators and industry groups have promoted for a number of corporate governance reforms to address some of the concerns raised by the Satyam scandal. Some of these responses have moved forward, mainly through introduction of voluntary guidelines by both public and private institutions.

Generally, India's corporate governance transformation efforts reflect the following:

- Significant industry involvement in assisting the government with crafting corporate governance measures.

- Substantial focus to enhance the function and structure of company boards, including (i) emphasis on the independence of the board of directors, and (ii) an increased role for audit committees.

- Noteworthy increase in disclosure to public shareholders.

Importance of corporate governance:

The Organisation for Economic Cooperation and Development (OECD) highlights the significance of good corporate governance in the global and domestic economic environment. According to OECD, if countries are to reap the full benefits of the global capital market, and if they are to attract long-term “patient” capital, corporate governance arrangements must be credible and well understood across borders. Even if companies do not rely primarily on foreign sources of capital, adherence to good corporate governance practices will help to improve the confidence of domestic investors, may reduce the cost of capital, and ultimately induce more stable sources of financing (Principles of Corporate Governance, 1990).

Important issues in corporate governance:

There are number of important issues in corporate governance. All the issues are inter related and interdependent to deal with each other. Each issues linked with corporate governance have different priorities in each of the corporate bodies.The issues are mentioned below:

- Value based corporate culture

- Holistic view

- Compliance with laws

- Disclosure, transparency, & accountability

- Corporate governance and human resource management

- Innovation

- Necessity of judicial reforms

- Globalization helping Indian companies to become global giants based on good corporate governance.

- Lessons from Corporate failure

- Value based corporate culture: For smooth operation of any firm, it is necessary to develop certain ethics, values. Long run business needs to have value based corporate culture. Value based corporate culture is good practice for corporate governance. It is a set of ethics, principles which are inviolable.

- Holistic view: This holistic view is religious outlook which helps for effective operation of organization. It is not easier to adopt it, it needs special efforts and once adopted it leads to developing qualities of nobility, tolerance and empathy.

- Compliance with laws: Those companies which really need advancement, have high ethical values and need to run long run business they abide and comply with laws of Securities Exchange Board Of India (SEBI), Foreign Exchange Regulation Act, Competition Act 2002, Cyber Laws, Banking Laws.

- Disclosure, transparency, and accountability: Disclosure, transparency and accountability are important feature for good governance. Timely and accurate information should be disclosed on the matters like the financial position, performance. Transparency is needed in order that government has faith in corporate bodies. Transparency is needed towards corporate bodies so that due to tremendous competition in the market place the customers having choices don't shift to other corporate bodies.

- Corporate Governance and Human Resource Management: In corporate culture, employees are vital for success of firms. Every individual should be treated with individual respect, his achievements should be recognized. Each individual staff and employee should be given best opportunities to prove their worth and these can be done by Human Resource Department. Thus in Corporate Governance, Human Resource has a great role.

- Innovation: Every corporate body must involve in innovation practices i.e. innovation in products, in services and it plays a critical role in corporate governance.

- Necessity of Judicial Reform: There is requirement of judicial reform for a good economy and also in today's varying time of globalization and liberalization. Judicial system of India though having performed salutary role all these years, certainly are becoming obsolete and outdated over the years. The delay in judiciary is due to several interests involved in it. But then with changing scenario and fast growing competition, the judiciary needs to bring improvements accordingly. It needs to promptly resolve disputes in cost effective manner.

- Globalization helping Indian Companies to become global giants based on good governance: In today's competitive environment and due to globalization, several Indian Corporate bodies are becoming global companies which are possible only due to good corporate governance.

- Lessons from Corporate Failure: Corporate body have certain policies which if goes as a failure they need to learn from it. Failure can be both internal as well as external whatever it may be, in good governance, corporate bodies need to learn from their failures and need to move to the path of success. To summarize, corporate governance encompasses systems and procedures designed to structure authority, balance responsibility and provide accountability to stakeholders at all levels. Fundamentally, corporate governance is about harmonising success with sustainability. Management literature have shown that corporate Governance is a set of ideas, innovation, creativity, thinking having certain ethics, values, principles which gives direction and shape to its people, personnel and possessors of companies and help them to succeed in global market.