Reconciliation and Integration between financial and cost accounts

In business realm, reconciliation may be represented as process of tallying the working results or profit as shown by cost accounts with that of financial account. Eric Kohler described that reconciliation is the determination of the items necessary to bring the balances of two or more related accounts or statements into agreements. Therefore Reconciliation and Integration between financial and cost accounts involve the process of recognizing and accounting for the items which have led to the difference in working results as revealed by cost and financial accounts. The reconciliation is made in an analytical form presented in the shape of statement or memorandum account (Narsis, 2009).

Cost and financial accounts are maintained separately, the difference between the end result of these two are required to be reconciled. Reconciliation of cost and financial accounts entail totalling the profit or loss revealed by both set of accounts. The principal aim of reconciliation is to find out the grounds for the difference between the results shown by Cost Accounts and Financial Accounts. Reconciliation of Cost and Financial Accounts is process to find all the reasons behind difference in profit which is calculated as per cost accounts and as per financial accounts. There are various items which are revealed in the profit and loss account only when accountants make it as per financial accounting rules. There are lots of items which are shown in costing profit and loss account only when they calculate profit as per cost accounting.

Importance of Reconciliation

Reconciliation of cost and financial account is needed for various reasons:

- To ensure arithmetical accuracy of both set of accounts for effective cost ascertainment and cost control.

- Reconciliation of cost and financial account is required to identify the reasons for different results in two sets of accounts.

- It facilitates internal control since it discloses the reasons for variations for effective internal control.

- Reconciliation of cost and financial account is needed to enable the smooth co-operation and co-ordination between the activities of cost and financial accounting departments.

- Reconciliation of cost and financial account is essential to make certain the standardization of policies relating to stock valuation, depreciation and absorption of overheads.

It is shown in literature that Reconciliation assist in ascertaining the accuracy and reliability of various sets of books of account maintaining in business concern (Narsis, 2009).

The discrepancy between financial and costing results may be due to numerous reasons.

- First is items shown only in financial results but no place in cost accounts. These may be items of expenditure or items of income or appropriation of profits. Such items are grouped under headings:

- Purely financial charges: These includes discount of debentures, loses on the sale of fixed assets, loses on investments, interest on bank loans mortgages and debentures, expenses of the company's share transfer office.

- Purely financial incomes: These are profits on the sale of fixed assets, transfer fee received, dividend received, interest received on the bank deposits, loans, rent received commission received.

- Appropriation of profits: These are income tax and super tax, dividends paid, transfers to reserves or sinking funds, donations and charities, amount of written off goods and preliminary expenses.

- Items shown only in cost account: There are certain items which are included in cost account but not in financial account. These items are very few and are usually notional charges such as interest on capital employed in production but not paid, nominal rent charges of premises owned by the concern.

- Over and under observed option of overhead in cost account: Overhead observed in cost account may be more or less than actual amount spent, if overhead expenses in cost accounts are more than actual. It is called over absorption. If overhead expenses in cost accounts are less than actual, it is termed as under absorption of overheads and leads to difference in two accounts. In such cases, costing profits will be higher and reconciliation is required.

- Different base of stock valuation of material: In the financial accounts, stocks are values at cost or market price whichever is lower. But in cost accounts, stocks of material are valued at cost. In financial accounts, stocks of finished goods are normally valued at prime cost. In cost accounts, however, they are valued at prime cost with appropriate proportion of production and administrative overheads. The difference in basis of valuation of stocks of material and finished goods may cause variations therefore reconciliation is needed.

- Abnormal wastages: Abnormal wastages of material and time is included in financial account but excluded from cost account. Reconciliation of profit and loss of cost account with that of financial account is done by means of memorandum reconciliation or simply by reconciliation statement (Narsis, 2009).

Methods of Reconciliation

When there is difference between profits disclosed by cost accounts and financial account, following steps must be taken to prepare reconciliation statement:

- Determine the extent of difference between the profit or loss disclosed by two set of book of accounts.

- Take the base profit or loss as per any set of books (either cost or financial) of accounts as the starting point.

- Prepare a statement by making suitable adjustment of items either added or subtracted included in one set of accounts but not in the other set.

- In other words. Balances as per cost account has been taken as the starting point, then balance as per financial account is to be adjusted according to the transaction recorded in the financial accounts and vice versa.

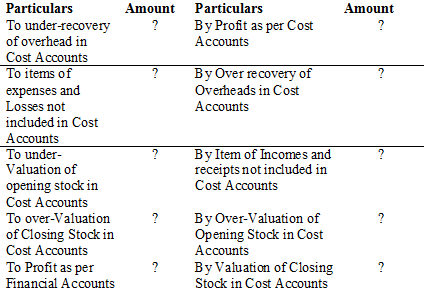

Reconciliation of cost accounts and financial account may be presented in the form of an account prepared on memorandum basis. Such an account is known as memorandum reconciliation account. The amount of profit as per cost account is shown on the credit side of this account. The various items to be added to the profit as per cost account are credited into the memorandum reconciliation account and the items to be deducted from profit as per the cost account, are debited to it. The difference between two sides of account will reveal the amount of profit or loss as per financial account (Narsis, 2009). The specimen of memorandum reconciliation account is shown below:

memorandum reconciliation account (Source: Narsis, 2009)

Problems in Reconciliation

In investigation following problems may take place (Banerjee, 2014):

- Profit as per financial cost books are to be reconciled on the basis of information given.

- Profit as per one set of accounts will have to be calculated first and then reconciled with given profit as per another set of accounts.

- Profit as per financial cost books are to be ascertained and then reconciliation to be made.

- Profit as per one set of accounts is given and profit as per another set is to be found out with help of reconciliation statement on the basis of given information.

- Preparation of pro-forma reconciliation statement.

Integrating accounting system involves the combination of cost accounting and financial accounting. Cost accounting is the classifying, recording and appropriating allocation of expenditure for the determination of the costs of product and services and for the presentation of properly arranged data for the purpose of control and guidance of management. Financial accounting is associated with the recording and summarizing of financial transactions and preparation of financial statements in accordance with GAAP. It reports on the financial conditions and profitability of the business to owners. In integrated system, only one set of accounts are maintained. This set of book fulfils the principles of Cost accounting and financial accounting. In this system, nominal accounts follow the principle of cost accounting. Real accounts and personal accounts are kept in accordance with financial account principles.

Integrated Accounting system is defined as the interlocking of financial and cost accounting system to ensure that all relevant expenditure is absorbed in to the cost accounts (Rajasekaran, 2010). For costing, it provides sufficient information to ascertain the cost of each product, process, job, operation and to perform necessary analysis. For financial accounts, it provides relevant information for the preparation of profit and loss as well as the balance sheet as per the requirement of law (Chakraborty, 2004).

There are several benefits of integration of cost and financial accounting. First, duplication of work is avoided. It saves time and energy. Instead of cost ledger, control account, general ledger adjustment account, purchase account and stores ledger account, only one set of account books are maintained to save time and money. As there will be only one figure for profit or loss, problem of reconciliation profits, as shown by cost and finance books will not arise. Through integration, correct and reliable data can be obtained. In this system, all expenses are included in cost accounts. It leads to an automatic check on costs and ensures better control over it. It is shown that all accounting information is available in one place. This system is useful under mechanized system of accounting. Though integration of cost and financial accounting has various benefits, it has some demerits also. This system has to fulfil the requirement of both cost and financial accounts. In any case perfect integration is not possible. This system is not suitable for large scale manufacturing factories (Rajasekaran, 2010.).

To summarise, reconciliation is process by which profits revealed by two sets of books are tallied after ascertaining the reasons for disagreements of the two profits. It involves the procedure to recognize and accounting for the items which have led to the difference in working results as shown by the cost accounts and financial accounts. Integration denotes to single accounting system where cost and financial account systems are maintained in the same set of books of account. It provides the information required by costing and financial accounts completely.