The Statement of Cash Flows

Cash flow statement is imperative term in accounting arena. The statement that explains cash inflows and outflows of a company for a particular period is known as the cash flow statement. Cash flow statement reveals where the cash has come during the period and what company has done with the available cash. Therefore, cash flow statement demonstrates the real process of cash movement occurred in and out from company during a year in a concise form. Cash flow statement also shows sources and applications of cash of a firm for a year. It is to be noted that the cash flow statement is not a cash book because it demonstrates inflows and outflows of cash and near to cash items. Cash cover entire items of existing assets and current liabilities. The cash flow statement reports increase and decrease in cash by listing in significant categories in terms of operating, investing and financing process.

The statement of cash flows, considered as analytical device, is constructive to determine the short-term feasibility of a company, particularly its capability to pay bills. Cash flow statements is beneficial for Accounting employees, who need to identify whether the organization will be able to cover payroll and other urgent expenses, Potential lenders or creditors, who want to know the real status of a company's capability to repay, Potential investors, who need to assess whether the company is economically strong, competent employees or contractors, who want to identify whether the company can afford payment and Shareholders of the business. It can be recognized that The Cash flow statements offers pertinent financial information about the cash receipts and cash disbursements of company during a financial year. This information is particularly vital to shareholders and creditors. As part of their investment return, shareholders often anticipate receiving dividends, and the ability to pay cash dividends depends on the availability of cash flows. Creditors are more concerned about company's ability to make interest and principal payments on loans they have made to the firm. Basically, the statement of cash flow reports the influence of company's operating, investing and financial operations on cash flows over an accounting period. The cash flow statement is considered to translate the accrual basis of accounting used in the income statement and balance sheet back to a cash basis.

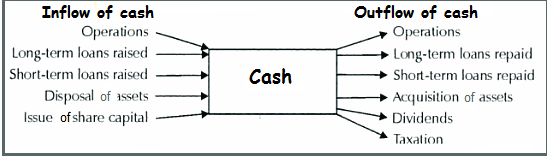

Main types of flow of cash

Objectives of Cash Flow Statement: Major objectives of cash flow statement are as under:

Aim of cash flow statement is to provide information about the cash inflows and cash outflows from operating, financing and investing activities of the firm, to demonstrate the impact of the operating, financing and investing activities on cash resources, to inform how much cash came in during the period, how much cash went out and what the net cash flow was during the period, to describe the causes for changes in cash balance and to recognize the financial requirements and help in forecasting future cash flows.

Methods: There are two extensively used methods to report cash flows from operating activities such as the direct method and the indirect method.

- The direct method decides net cash used by operations by directly subtracting major classes of operating cash inflows. Items that normally do include:

- Cash collected from customers

- Interest and dividends received

- Cash paid to employees

- Cash paid to suppliers

- Interest paid

- Income taxes paid

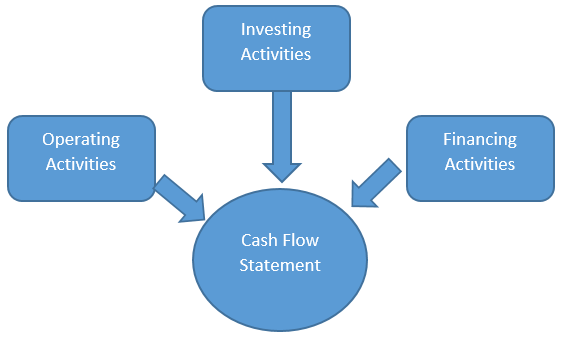

- The indirect method presents net income. Net income is then translated to a cash basis by making adjustments for changes in noncash current assets and current liabilities that relate to operating activities, adjustments for items that relate to operating activities but do not present cash inflows or cash outflows during the period, adjustments for gains and losses that do not relate to operating activities. Under this method, Cash flows in the statement are categorized into three areas:

Operating activities: These represent the revenue-generating activities of a business. Examples of operating activities are cash received and disbursed for product sales, royalties, commissions, fines, lawsuits, supplier and lender invoices, and payroll. Other examples are Cash payment to or on behalf of employees. Cash payment and refunds of income taxes.

Investing activities: These constitute payments made to acquire long-term assets, as well as cash received from their sale. These activities are acquisition and disposal of long term assets and other investments not included in cash equivalents. For example, investing activities are the purchase of fixed assets and the purchase or sale of securities issued by other entities, cash receipts of sale of property,

Financing activities: These constitute activities that will modify the equity or borrowings of a business. These are activities that result in changes in the size and composition of equity capital and borrowings of enterprises. Such as the sale of company shares, the repurchase of shares, and dividend payments, cash repayment of amount borrowed.

It is to be noted that both cash inflow and outflow are recorded under each of three categories. The cash flow statement balances to the net movement in cash and equivalents.

Both methods are currently suitable, but enterprises are optimistic to report operating cash flows using the direct method. The benefit of the direct method over the indirect method is that it expresses operating cash receipts and payments.

Benefits of The statement of cash flows: The information in a statement of cash flows assists investors, creditors, and others. It helps to assess the company's ability to produce future cash flows. By investigating relationships between items in the statement of cash flows, investors and others can forecast the amounts, timing, and ambiguity of future cash flows and the company's ability to pay dividends and meet obligations. Employees, creditors, stockholders, and customers should be mainly concerned in this statement because it demonstrates the flows of cash in a business. Several financial statement clients scrutinize the reasons for the difference between net income and cash provided by operating activities and then they can consider for themselves the reliability of the income numbers. It is established in reports that Cash Flow Statement is helpful to evaluate financial policies and current cash position. Since cash is the basis to do operations, the Cash Flow Statement prepared on an estimated basis for the next accounting period will facilitate the management to plan and synchronize the financial operations probably. Cash Flow statement serves as a control tool for the management. An assessment of cash flow statement of previous year with the budget for that year would specify to what extent the resources of the enterprise were raised an applied according to the plan. Therefore a comparison of original forecast with actual results may emphasize trends of movement that might otherwise go unnoticed. Cash flow statement presents clear status of cash inflow from operations therefore, it is vital to internal financial management to consider the possibility of retiring long-term debts, in planning replacement of plant facilities or in formulating dividend policies. Another advantage of cash flow statement is that it facilitates the management to account for situation when business has earned enormous incomes yet run without money or when it has suffered a loss and still has ample money in the bank. Lastly, Cash Flow Statement assists the management to take short-term financial decisions.

The cash flow statement can emphasize other major factors to consider in a business's strategy. A cash flow statement explains if a business is running out of money, even if it is profitable at the same time. Fast growing businesses often demonstrate a net income but have their cash tied up in accounts receivable or rely too much on bank financing. A cash flow statement clarifies how much money was used to buy property and equipment. It is important to know the cash impact that fixed asset investments have, since net income can be significantly affected by depreciation and paying back. A cash flow statement also describes how loan payments affect cash in the bank. A cash flow statement is intended to assist a customer make these evaluations and to respond specific queries such as, What accounts for the difference between cash and cash equivalents at the beginning of the year and at the end of the year?, What was done with the cash raised from the sale of bonds or shares?, How did the business finance its purchases of machinery or other capital assets?, How was it possible to pay dividends when the business reported a net loss on its income statement?, Does the firm have the ability to pay off the mortgage on its office building?

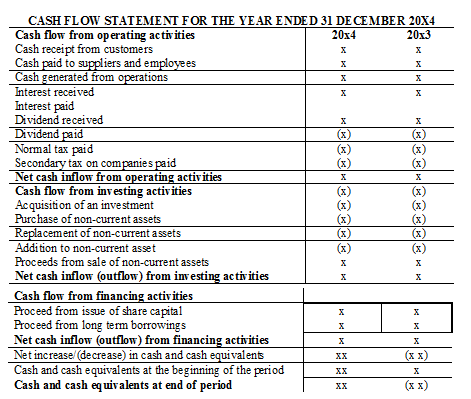

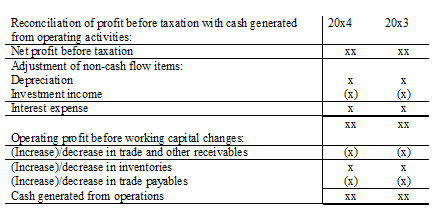

Figure: Format of cash flow statement ( Source: Flynn, 2005)

A reconciliation between the net profits before taxation reported in the income tax statement and the cash generated from operations should be given as a note to the financial statements.

Note To The Cash Flow Statement

To, summarize, the cash flow statement is proposed to give information on a company's liquidity and solvency, enhance the comparability of different firms' operating performance, and to designate the amount, timing, and possibility of future cash flows. The statement of cash flows is major constituent of the fiscal statements issued by a business, and explains the cash flows into and out of the business.